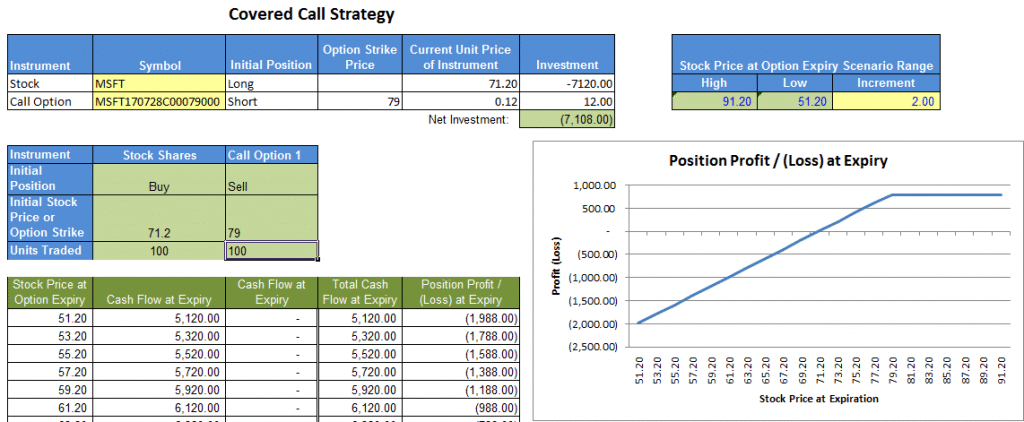

By utilizing an options profit calculator, traders can efficiently evaluate the break-even point, maximum profit, maximum loss, and hedging potential of their positions, ensuring a comprehensive understanding of the investment landscape.Īn options profit calculator is an indispensable tool for both novice and experienced traders, as it streamlines the profit/loss calculation process while considering the intricate dynamics of the options market.

Mastering these elements can significantly improve a trader’s risk/reward ratio and overall success in the market. One crucial aspect of options trading is the ability to accurately analyze and predict the profit/loss potential of a given position, taking into account various factors such as call option or put option, strike price, implied volatility, time decay, and the “greeks” (delta, gamma, theta, vega). In the world of stock market investing, the options market has emerged as a popular avenue for traders seeking to capitalize on opportunities presented by derivatives. Importance of Using an Options Profit Calculator

#Call put profit calculator full#

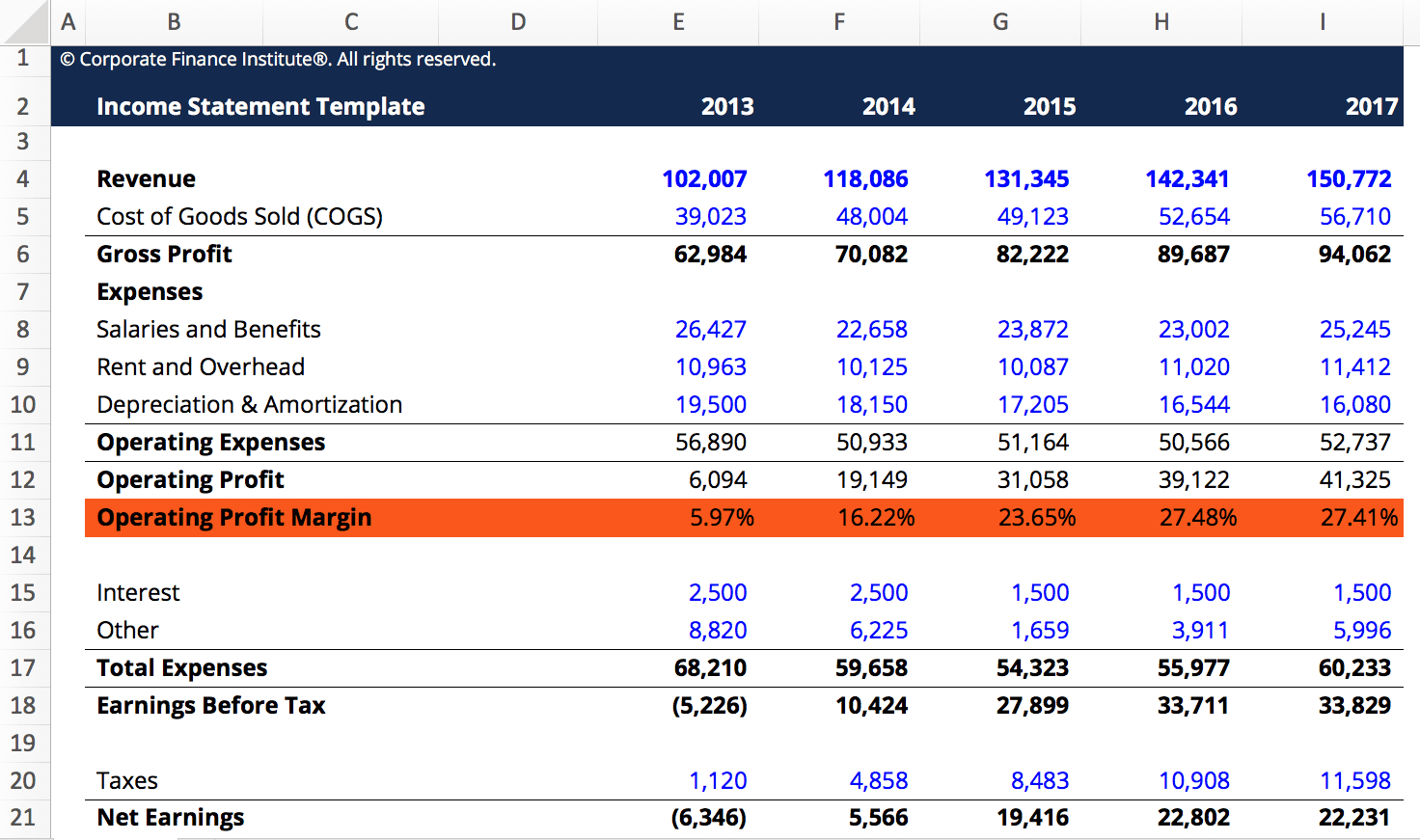

By mastering these key concepts and honing their analytical abilities, investors can unlock the full potential of options trading and capitalize on the opportunities presented by the stock market and derivatives landscape.Ĭlick here to learn more about the basics of options trading 1.2. Evaluating the risk/reward ratio is another essential skill that enables traders to make informed decisions in the fast-paced world of options trading. In addition to understanding the mechanics of options contracts, successful traders must be proficient in profit/loss calculation, determining the break-even point, and identifying the maximum profit and maximum loss scenarios for any given trade. To navigate this complex market effectively, it is crucial to understand the role of implied volatility, time decay, and the greeks (delta, gamma, theta, vega) in shaping the value of an option over time. The options market, a subset of the broader derivatives market, is an arena where traders can employ strategies such as hedging to reduce the risks associated with fluctuations in the value of their investments. These two types of option contracts grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified strike price before the contract expires. Investors are able manage risk and potentially maximize profits through the use of call options and put options. Randy Frederick, managing director of trading and derivatives for the Schwab Center for Financial Research, told CNBC, “The amount of downside is so little compared to the potential benefit.” Options trading is a powerful financial instrument in the stock market. By mastering these concepts, one can make more informed decisions and thrive in the competitive financial markets. This introduction aims to provide an overview of options trading and highlight the importance of using an options profit calculator. To manage risk and optimize your investment strategy, it’s crucial to analyze profit/loss calculations, break-even points, maximum profit, maximum loss, and risk/reward ratios. The options market offers a unique opportunity for hedging and maximizing returns with the help of greeks (delta, gamma, theta, vega) and other metrics like implied volatility and time decay. In the dynamic world of options trading, understanding key concepts such as call option, put option, and strike price is essential to navigate the stock market and derivatives landscape.

#Call put profit calculator pdf#

Please view our Privacy Policy and our User Agreement.Free PDF Guide: Mastering the Options Profit Calculator ©1998-2023 The Options Industry Council - All Rights Reserved. Continued use constitutes acceptance of the terms and conditions stated therein.

User acknowledges review of the Terms and Conditions and Privacy Policy governing this site. ©1998-2023 The Options Clearing Corporation.

Franklin Street, Suite 1200, Chicago, IL 60606. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, 125 S. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Options involve risk and are not suitable for all investors. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. This web site discusses exchange-traded options issued by The Options Clearing Corporation. OCC 125 South Franklin Street, Suite 1200 | Chicago, IL 60606

0 kommentar(er)

0 kommentar(er)